Invest in Market linked debentures with InCred Premier

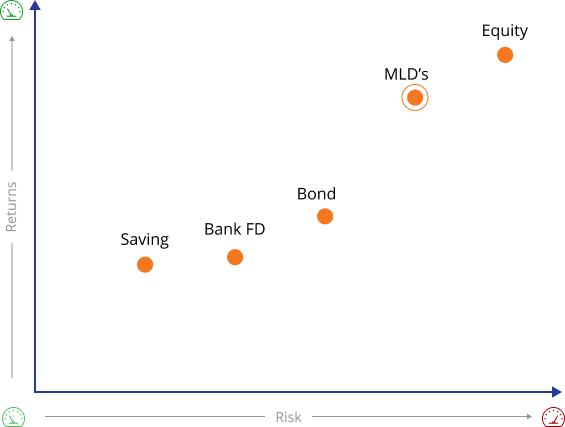

Diversify your investment portfolio by considering Market-Linked Debentures (MLDs), which blend the features of fixed-income instruments with the opportunity for increased returns tied to equity market performance. These structured investment products strike a balance between risk and reward, enabling you to potentially benefit from market gains while receiving regular coupon payments, providing an added layer of security.

What are Market-Linked Debentures?

Market-Linked Debentures (MLDs) are hybrid investment options issued in the form of bonds. The returns or interest received on MLDs are dependent on the performance of the underlying market, such as the Nifty 50 Index or Nifty 100 Index.

-

Higher potential returns

-

Flexibility and customization

-

Diversification and risk management

Types of Market-Linked Debentures

While specific types of MLDs are not mentioned in the provided information, market-linked debentures can have various structures and underlying assets.

-

Principal Protected MLDs

These MLDs provide investors with a level of capital protection. They guarantee the return of the initial investment amount at maturity, regardless of the performance of the underlying market index. -

Non-Principal Protected MLDs

Unlike principal protected MLDs, these MLDs do not guarantee the return of the initial investment amount at maturity. The returns of these MLDs are directly linked to the performance of the underlying market index, providing potential for higher returns but also exposing investors to higher risk.

Advantages of Market-Linked Debentures (MLD’s)

-

Downside protection

Principal protected MLDs offer investors the benefit of downside protection, as they guarantee the return of the initial investment amount at maturity.

-

Potential for higher returns

Non-principal protected MLDs provide the potential for higher returns compared to traditional fixed-income investments.

-

Diversification

This helps spread risk and reduce exposure to any single investment, potentially improving the overall risk-return profile of the investment portfolio.

-

Customization

Investors can choose from a variety of MLD structures, such as those with principal protection, currency exposures, or tailored coupon payments based on specific conditions.

Begin your investment journey with InCred Premier

How Market-Linked Debentures work?

-

In India, a company named ABC Ltd. issues MLDs to investors, with a maturity period of 5 years and a principal investment amount of ₹1,00,000 per MLD.

-

The MLDs are linked to the performance of the Nifty 50 Index, which represents the top 50 companies listed on the National Stock Exchange (NSE) in India.

-

The MLDs offer 100% principal protection, ensuring that at maturity, investors will receive back their initial investment amount of ₹1,00,000, irrespective of how the market performs.

-

Along with principal protection, the MLDs offer potential upside based on the performance of the Nifty 50 Index.

-

If the Nifty 50 Index performs well over the 5-year period, investors may receive additional returns on top of their principal investment. For example, if the index returns 12% annually, the investor would receive a total return of ₹1,60,090 (₹1,00,000 principal + ₹60,090 returns).

Insights about the market.

Hear What Our

Clients Have To Say

Start your investment journey with InCred Premier today